Financial management and reporting for businesses today is not just about traditional financial statements such as balance sheets, profit/loss reports and cashflow statements.

Instead, organisations must look beyond this and harness the power of data visualisation, business intelligence and even artificial intelligence to make more timely, forward-looking and data-driven business decisions.

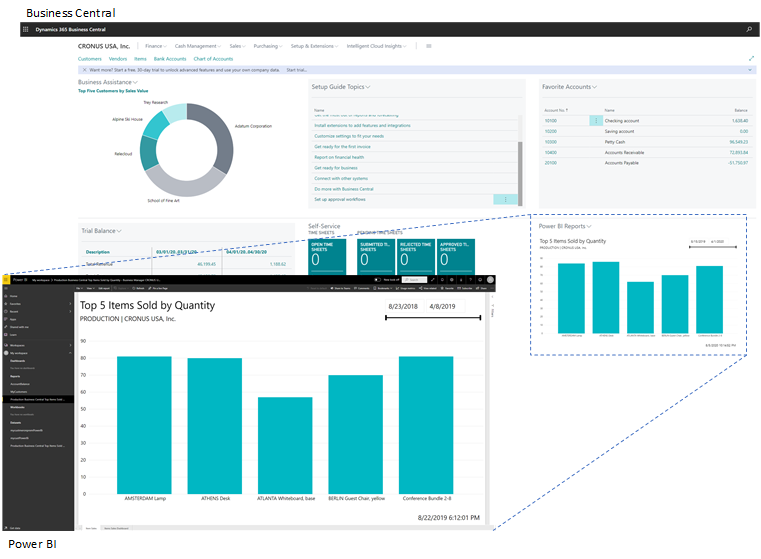

With Dynamics 365 Business Central in the cloud delivering a fully integrated ERP (enterprise resource planning) solution, you’ll get the tools needed to analyse your data for financial management and reporting.

So, what options are available to you out-of-the-box to produce the financial reports you need?

- Pre-built Excel financial statements

- Customised role centres

- Intelligent cloud insights

- Analyse data by dimensions

- Build financial reports using account schedules

- Embedded Power BI reports

1. Pre-built Excel financial statements

Integration with the rest of the Microsoft products is at the heart of Dynamics 365 Business Central. Pre-built Excel-based reports can be saved to your PC and allow your users to access refreshable reports which can easily pull data out of Business Central.

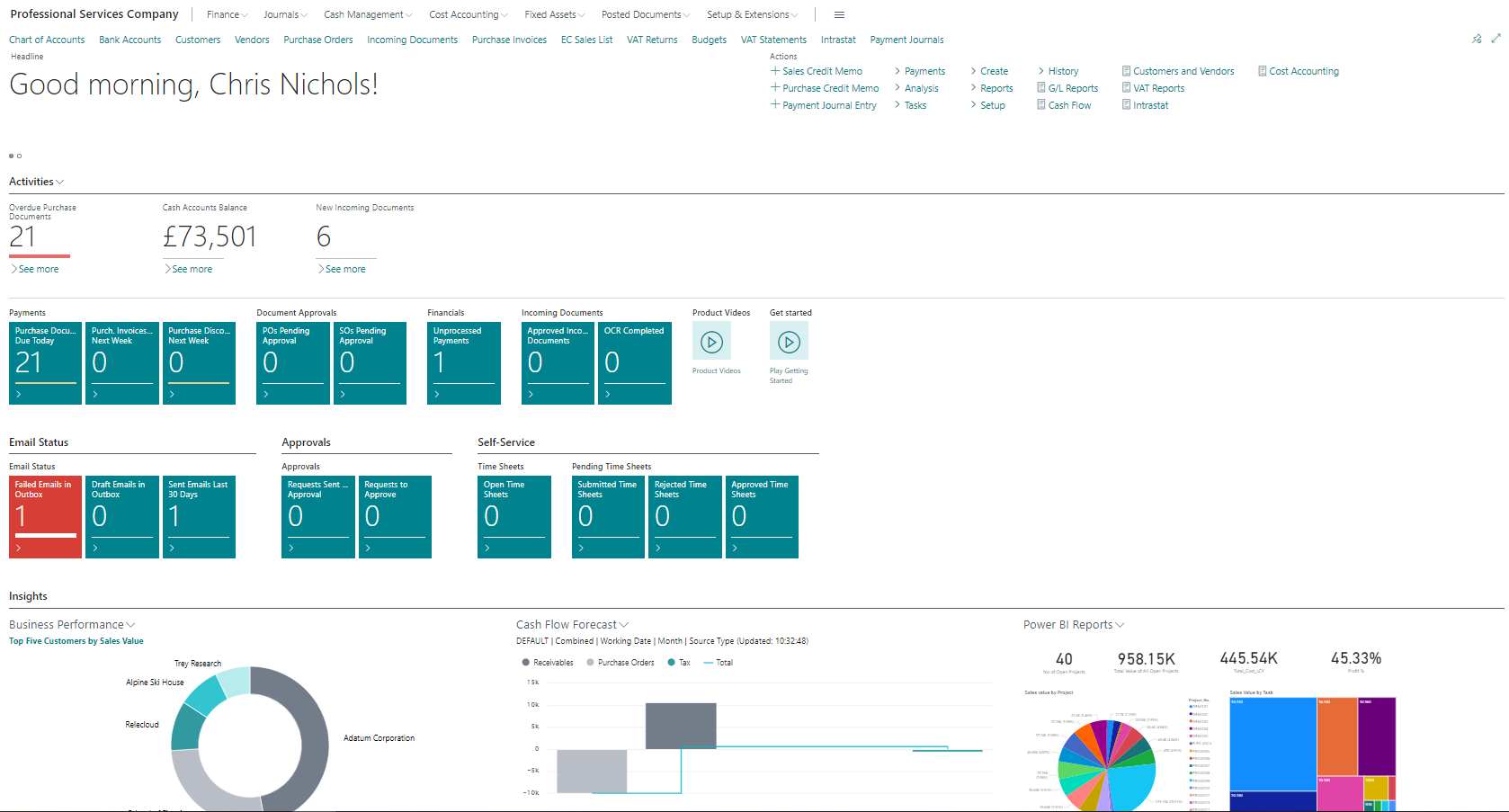

2. Customised role centres

Out-of-the-box role centres can be personalised to present finance-based dashboards with statistical cues, graphical charts and key financial information. This can be used to track financial performance as well as monitor costs and financial risks.

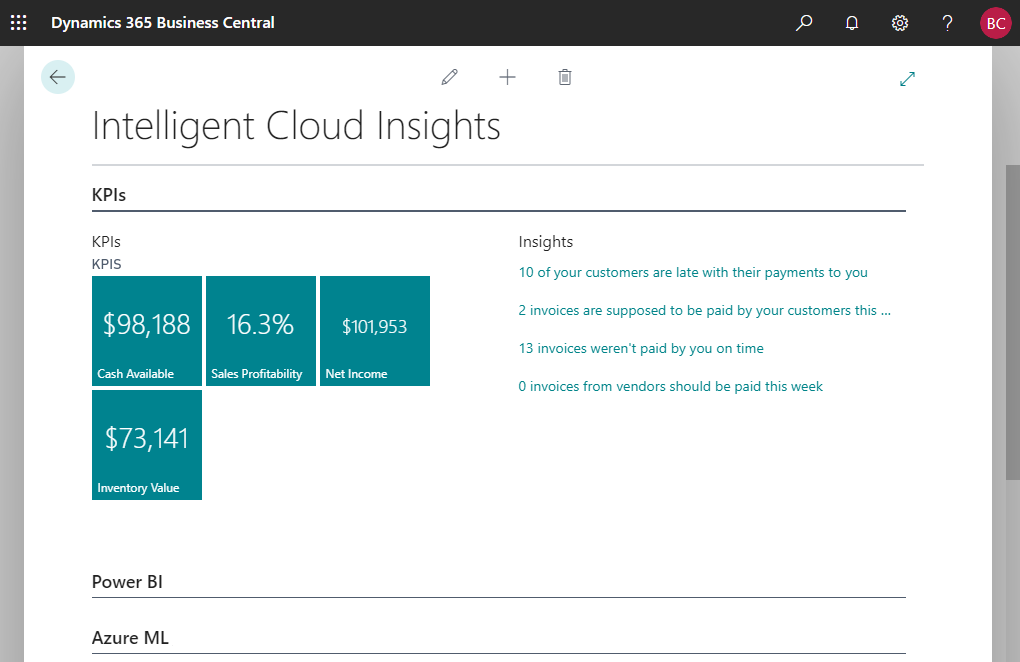

3. Intelligent cloud insights

With intelligent cloud, you can analyse financial data to provide insights into your financial key performance indicators (KPIs). Also, your historical data that’s fed through Azure Machine Learning enables you to view the future projection of your company’s financial wellbeing, such as providing cashflow forecast and prediction on customer’s payment statuses.

Intelligent cloud insights provide four key points of interest for your business:

- Cash availability

- Sales profitability

- Net income

- Inventory value

You also get insights into your potential areas of concern, such as overdue payments. The page can be connected to Power BI or Azure AI for even more insights.

4. Analyse data by dimensions

In financial analysis, a dimension is data you can add to an entry as a kind of marker. This data is used to group entries with similar characteristics like:

- Customers

- Regions

- Products

- Salesperson

Analysing data by dimensions provides greater insight into your organisation so you can evaluate information like:

- How well your business is operating

- Where it is/isn’t performing

- Where more resources need to be allocated

By combining analysis by dimension view with general ledger in account schedules, you can use the report writing functionality to produce financial reports in different compositions and structures.

5. Build financial reports using account schedules

Account schedules can be used as a powerful financial reporting tool. For example, include your essential business data from the chart of your accounts, budgets, cash flow accounts and cost types in financial reports.

This data helps you to efficiently monitor the health of your business and provide vitial input for your decision makers. Tools like define row, column layouts and combinations help you generate the reports you need. Also, use calculate/sub-totals and control the print output to compare your current/historical budget figures.

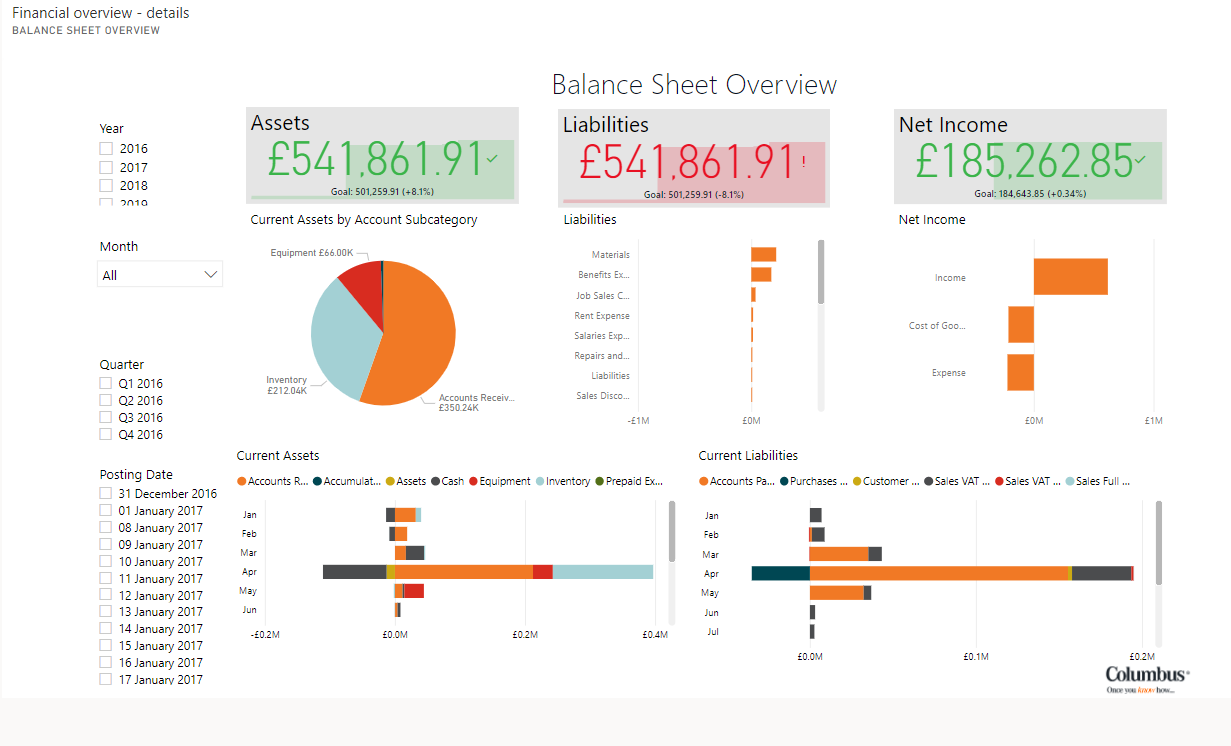

6. Embedded Power BI reports

Power BI offers a flexible alternative to reports created in Business Central, enabling you to:

- Drill down into your data

- Customise visualisations

- Merge data from different companies in Business Central

Some Power BI reports can also be embedded in Business Central and viewed without leaving the system. Power BI is closely integrated in Business Central, which helps fill the gaps of some reporting and analysis limitation, allowing you to slice and dice your financial data in a way best suited to you.

You can read more into the benefits of using Power BI for your business by clicking here.

Scale and grow faster with the right digital solution

Dynamics 365 Business Central offers several tools to help you when it comes to financial management and reporting. The solution helps you go from legacy systems where large month end data exports are analysed through Excel to a platform with on-demand data analytics offering real time insights.

To find out more about the capabilities of Dynamics 365 Business Central and how it can improve your financial management and reporting, download our guide below.