Understanding and monitoring the cash flow of a business is a crucial analysis that a business should undertake. Not having the required statistics may provide inaccurate information about a company’s financial solvency. This might mean that a company is unable to make informed key decisions on future investments, expenses, and revenues. Nor ensure that there is enough cash flow available to meet the business’s financial obligations.

Key questions/issues faced by business accountants are -

• How much cash is moving in and out of a company?

• Are some months/periods better than others financially?

• How to evaluate cash surplus and deficit? Decisions to pay down debt or borrow is based on this result?

• Are there any inconsistencies in the accounts and the figures?

Advantages of Cash Flow Forecasting?

- Highlight the impact of cash gaps and potential consequences – For many SMEs, a late payment can lead to a big deficit in the bank. Having a cash flow forecast helps businesses to plan for situations that can impact cash flow. Businesses can choose to take loans to cover this gap and hence make informed future business decisions.

- Save effort on creating Spreadsheets – Creating a cash flow forecast in a spreadsheet can take a lot of valuable work hours. However, using a cloud-based cash flow forecasting lets the user focus on their day jobs and gives businesses back control thus saving a lot of valuable amount of time and money.

- Keep Track of Late Payments – Businesses need to keep track of late payers so that the businesses can put tighter credit control systems in place to chase late payments.

- Manage spare cash and plan growth – If the cash flow forecast can give users information about surplus cash in the bank, then businesses can use that additional cash for loan repayments or reinvestment.

- Track spending against the actual budget – Forecasting helps businesses to understand whether they are over or under their budgeting target. Having forecasted figures helps businesses to decide whether the budget figures need to be adjusted to make more accurate predictions in the future.

Microsoft Dynamics 365 Business Central has several tools that will help you to keep control of your finances and cash flow.

A simple way of looking at the receivables and payables in the company is by going to the ‘receivables-payables’ page in Business Central. Users can filter vendor and customer balance by day, week, month, quarter, period, year.

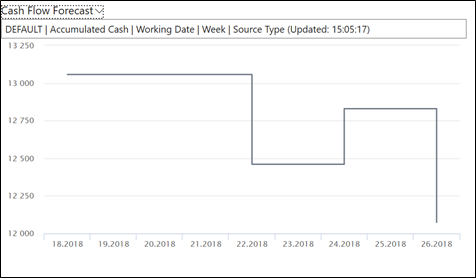

The above tool is good for an overview of customer and vendor balances, but to do a more detailed analysis for cash balances and bank accounts, you can create multiple cash flow forecasts in Business Central at any point in time. In the cash flow forecast card, you can specify the forecast period and include budgets as well.

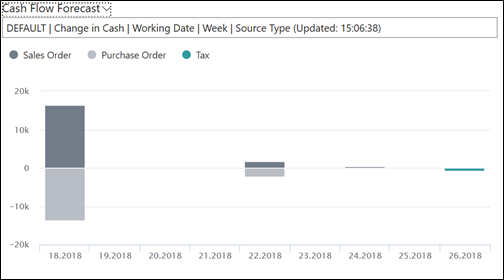

If you'd like to generate a cash flow forecast, you can calculate the cash flow based on a cash flow payment terms code which is specified for the Vendors and customers setup. The cash flow forecast shows the visibility of liquid funds, receivables, payables, sales orders, purchase orders. To extend the forecasting functionality, users can also enter predicted revenue and expenses in a journal like payroll payments, investment, loans and use this with the cash flow card to get a more accurate prediction of cash flow.

Though the cash flow forecast statistics give a good knowledge of the company’s cash flow position, visual charts and figures are much more effective in making solid decisions quickly and effectively. Business Central has some inbuilt charts which provide several ways of analysing cash flow –

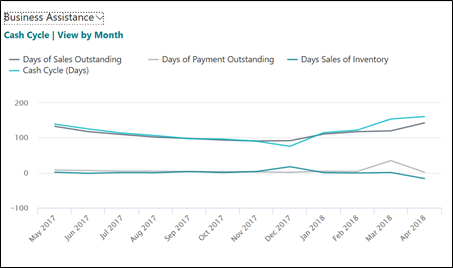

- Cash Cycle – Time is taken by the sales process to tie up your cash

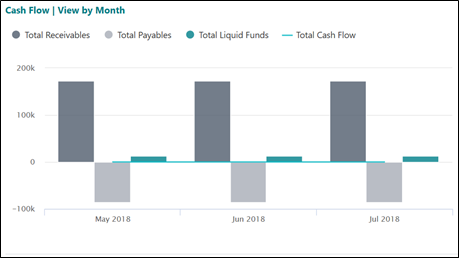

- Cash Flow – Movement of Cash in and out of a company

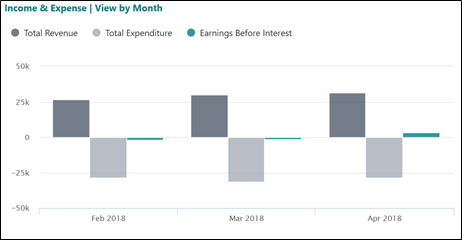

- Income & Expenses-Cash Flow Forecasts

-

Accumulated cash –

- Cash fluctuations –

Are ready to find out more?

Consider utilising a small Proof of Concept (POC) in an area of your business where the benefit has potentially high return for you.

If you'd like to find out how, please get in touch with us here.